Nothing is free in life but you can always be wise and choose to live debt-free.

Earning the bare minimum in the middle of this global economic crisis is an everyday nightmare. “The struggle is real”, this is what most people say and it’s just a matter of deciding whether or not you’d let being a low-income earner get the best of you.

It speaks to a deeper degree when it comes to elderly people, those who have already reached their senior years or retired due to some health problems. These inevitable situations leave them with insufficient choices but to put their fate on social security benefits and support from different government programs.

We always have a choice.

Being a low-income earner doesn’t mean living unhappily and in a lot of shortages. One can still live freely and happily without worrying about bills or all the necessities in life. We just need to follow a rule of thumb and enjoy living a frugal life.

But how is that possible? Simple!

Just follow these tips coming from an expert and someone who’s already been there and did it.

Her name is Sara, she is a wife, a mom, a Financial Coach, and the proud owner of frozenpennies.com where she teaches people how to be penny-wise. Her tips do not just educate people on how to be thrifty but also be happy while being on a tight budget.

Avoid compromising happiness.

In order to survive due dates and buying needs, you don’t need to be hard on yourself. According to Sara, she talked to a 76-year-old low-income woman named Anne who lives on her own, and shared how she’s able to live a frugal life.

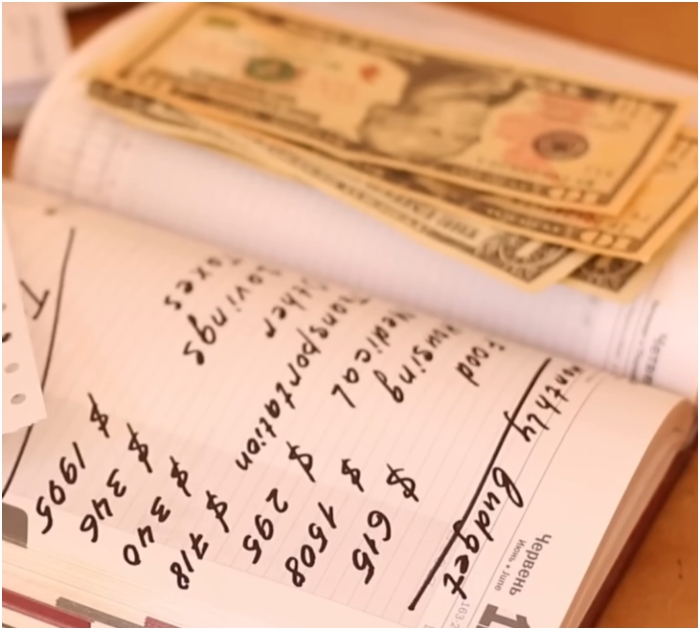

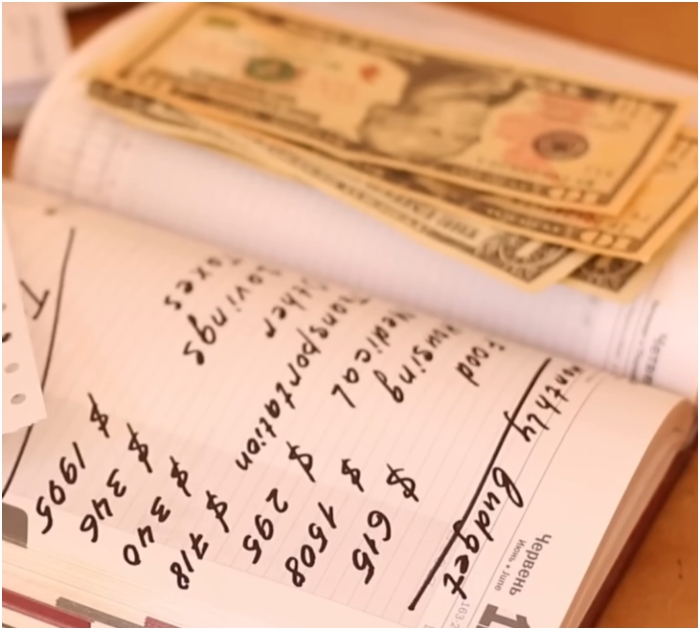

According to her, Anne always makes it a habit to check her expenditure. She does this by knowing the balance of her checkbook and looking at her bank statement once a month. By doing these things, you’d know exactly what you are spending on and if ever you are overspending.

Keeping track of money getting in and out is a basic principle in life whatever your status in life is. It is a good practice that can help anyone have full control of their budget at any point in a month or even a year.

Make your age an advantage.

At 76, Anne also told Sara that she doesn’t have any electronic devices at home that need internet. She only has cable and telephone, which alone gives a huge trim out of her monthly bills. The elderly woman also told the financial coach that she moved to a smaller place that meets her age’s needs.

That, once again, takes a large cut from her expenses. In the moving process, Anne sold everything she didn’t need in life. Not only did she earn from it but also took away a load of unnecessary things out of her baggage.

Another thing about her lifestyle is that she doesn’t own a credit card which she calls “evil.” When buying at a grocery store, it’s normal for her to look for “sale” items. Anne also takes advantage of HEAP and SNAP benefits, sometimes, she’d also get food from Meals on Wheels and free lunches from the Senior Center.

On top of all these, Anne pointed out 4 important things about frugal living: resourcefulness, contentment, happiness, and companionship.

Live a frugal life but make sure you have a great quality of life.

Know more about this story by watching the video below.

Please SHARE this with your friends and family.